Debt is scary. You can leverage debt to live the lifestyle you want, like getting a house or car. Excessive debt becomes an anchor that drags you to the bottom of the ocean.

My recent post on being your own bank presented three financial models. For the debtor, their liabilities accumulate faster than their assets. The interest expense builds up to a crushing burden.1

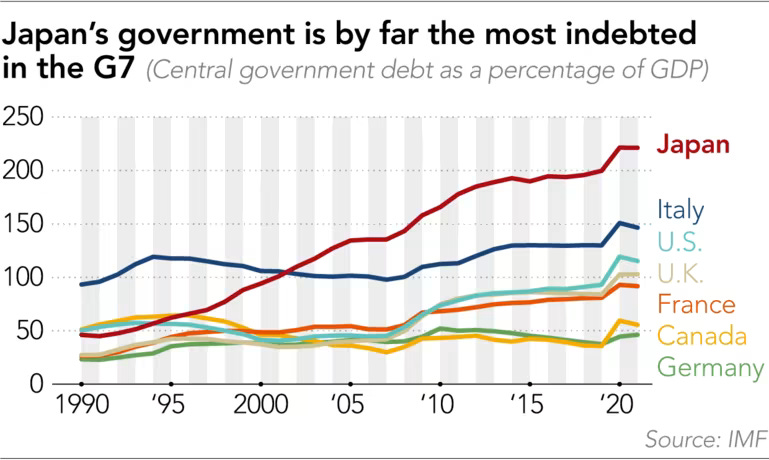

Many nations borrow recklessly to fund their state projects. The biggest culprit today is Japan. Japan has the highest debt-to-GDP ratio in the world.2

Interest rates are still low. What happens when interest rates rise? A country can impose taxes on it’s citizens or even pillage it’s weaker neighbors.

You, dear reader, are not a country. You are not likely to succeed running a protection racket. Being weighed down with debt and facing bankruptcy is not fun.

More than half of US households hold credit card debt. This burden affects lower-income folks disproportionately. Interest payments take a serious chunk out of their paychecks each month.3

Wealth Battler Jeff described how he felt about his debt:

I was just trying to keep my head above water… I thought that I was going to die with a chunk of debt that was hopefully going to go away. I felt exasperated.

Choose Freedom

Turning your debt around requires you to live within your means. You stick to your budget. You pay down the principal of your loans to a manageable level.

You can then form a strong base from which to grow and use leverage appropriately. You can build assets and borrow against them.

Setting up a budget is the first step on the journey to financial freedom. This helps you form a clear picture of your present financial life. Then you develop a vision of where you want to be in the future.

On the other side of this Jeff felt relieved:

Now I have a much more positive outlook on it. I can definitely see a light at the end of the tunnel. It puts it in perspective and things are a lot clearer.

It took me months to figure out where all the leaks were. Knowing the budget and having the debt destroyer set up I can get out of debt in six years. It makes you more hopeful.

You can implement strategies to tackle your debts. Most people’s initial intuition is to pay down their highest interest rate debt first. This reduces their interest expense.

Wealth Battle budget nerd Kason refers to this as the debt avalanche strategy.

But what if there are other options that work better for you? Suppose you have three debts:

A credit card with a small balance and minimum payment, but high interest rate

A car loan of medium balance, interest rate, and high payment

A mortgage of large balance, medium payment, and low interest rate

You can create an amortization table to map out the actual payment schedules. Then compare the cash-flow of different pay-off strategies. This reveals that some loans are more cash-flow efficient than others!

The debt snowball strategy pays off the highest required payment debt first. In this example you pay your car loan first. This frees up cash-flow to take on the credit-card debt.

A snowball gets larger and more powerful as it rolls down-hill. Freeing up cash-flow is handy for when an emergency or opportunity comes up. The snowball strategy requires less willpower than the avalanche. It comes at the slight cost of higher interest.

Then you can do some fun math! The cash-flow index of a debt is its balance divided by the minimum payment. For balance B and payment P, you compute the cash-flow index CFI as:

A low CFI index is an inefficient loan. A high index is efficient. This metric helps you focus on freeing up cash-flow at the cost of a higher interest expense. This technique gives you more breathing room to knock debts out.

Check out Kason’s FREE video explanation and spreadsheet here: