Inflation is the Cruelest Tax

Taxes and inflation are a fact of life in our fiat monetary system. Chances are you pay your rent or mortgage with Federal Reserve Notes (dollars).

You earn these dollars by working, investments, or running a business. The IRS gets a cut on your income. When you make a purchase, the local government takes another cut for sales tax. Every month your rent or mortgage includes local property tax. When you die, you pay estate tax. It’s absolute thievery!

You want to save money for emergencies or to make a down payment on a house or car. Yet every year the cost of living goes up so your savings loses value.

Banks increase the money supply in circulation. This was once accomplished by printing paper money. In the modern era of digital currency, banks extend credit in their computer systems.1

Monetary expansion in turn causes price inflation. This is the cruelest tax. It penalizes people who try to save for the future.

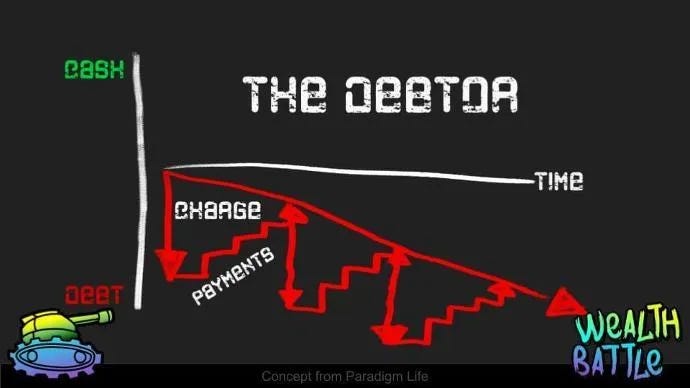

One method to cope with inflation is to be in debt. Inflation erodes the real cost of your debt over time. Debt works in your favor when your income increases faster than the interest rate.

The trouble comes when your income doesn’t increase the way you hoped. Then the debt burden and interest expense stacks up.

You are stuck spending an increasing share of your pay on interest. You feel like the situation is spiraling out of control. Debt becomes an anchor that pulls you to the ocean’s icy depths.

The Trouble With Stocks

Another approach is to save and invest. You buy assets that provide better returns than a savings account to keep ahead of inflation.

Investments like bonds, stocks, and cryptocurrency tend to appreciate over time. But they also can lose value.

The legendary value investor Warren Buffet laid out his rules for investing:2

Rule No. 1: Never lose money. Rule No. 2: Never forget Rule No. 1.

My previous post showed a chart of the returns on the S&P 500 stock index in the first decade of the new millenium:3 4

This chart is striking. How would buying the S&P 500 in the year 1999 would have performed over ten years? I asked Perplexity:5

If you had invested in the S&P 500 index in 1999, your investment would have performed poorly over the next 10 years. This period is often referred to as the "lost decade" for U.S. stocks…

If you invested at the beginning of 1999, by the end of 2008 (10 years later), your investment would have lost approximately 13% of its value, not accounting for inflation.

Including dividends, the total return would have been slightly negative or close to zero, depending on the exact start and end dates…

Inflation impact: When factoring in inflation, the real returns were even more negative.

Comparison to other periods: This was an unusually poor decade for U.S. stocks, as the S&P 500 has historically provided positive returns over most 10-year periods.

Perplexity rightly notes I am cherry-picking a particularly bad decade. This also looks at only a single asset class.

Yet the lost decade happened to real people. It’s challenging for a working person to outperform the S&P500. Most financial professionals fail to outperform the market. You’re unlikely to get results that are competitive with index funds.6

Protect and Grow Your Funds

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn't, pays it.”

~ Attributed to Albert Einstein

Going all in on stocks and cryptocurrency isn’t reliable. Then when you want to get a mortgage for a house, the down payment needs to be “seasoned.” That means the money needs to sit in a liquid account like checking or savings for two to three months.7

So you need to sell your investments, pay the capital gains tax, and move it to a liquid account. A more advanced strategy is to borrow against your investments. That is out of reach for the typical person.8

Savings or money-market accounts are helpful for this. You could also buy bonds. These vehicles let you take advantage of compounding interest.

But when you spend your savings this depletes your wealth. And then you owe taxes on the interest accrued!

Savings accounts and similar assets are low-risk but not low-tax. They don’t let you harness the power of leverage. Isn’t there a better way?

Your Bulletproof Vehicle

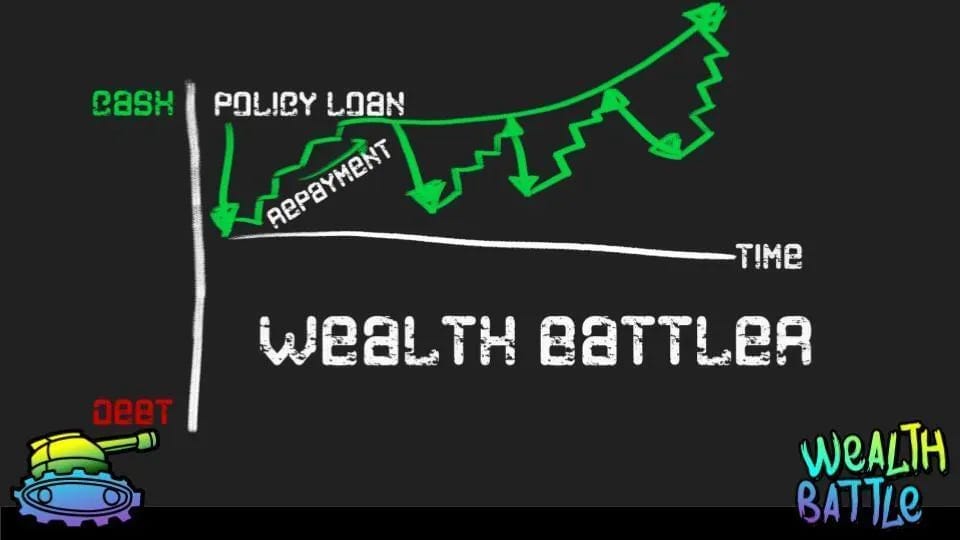

There is an asset that is low-risk and tax free. It is safe, liquid, and accessible. It’s value grows independent of the fickle stock market. You can use it to grow and protect your funds.

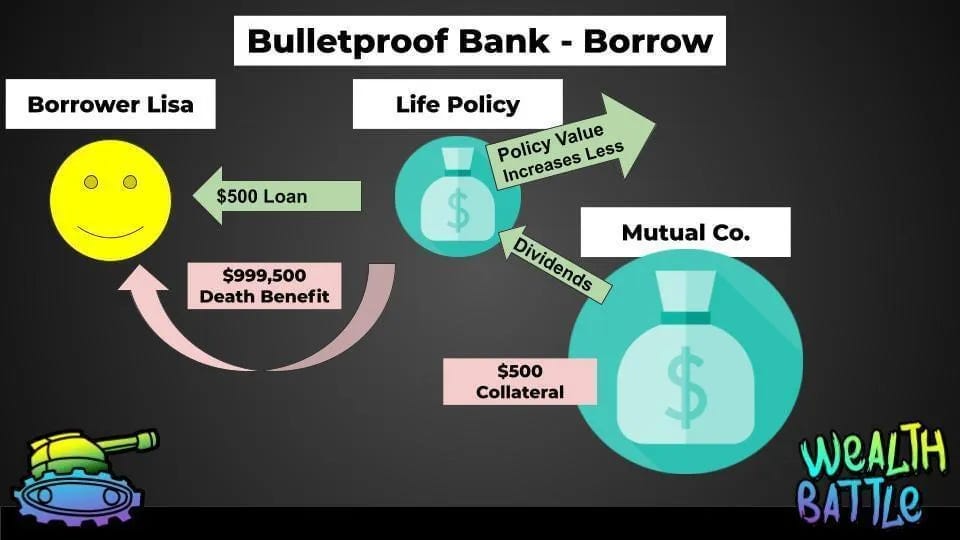

When you want to spend money, you can borrow against it and repay the loan on your time. The asset continues to appreciate while it is on loan. This way you can both leverage AND earn!

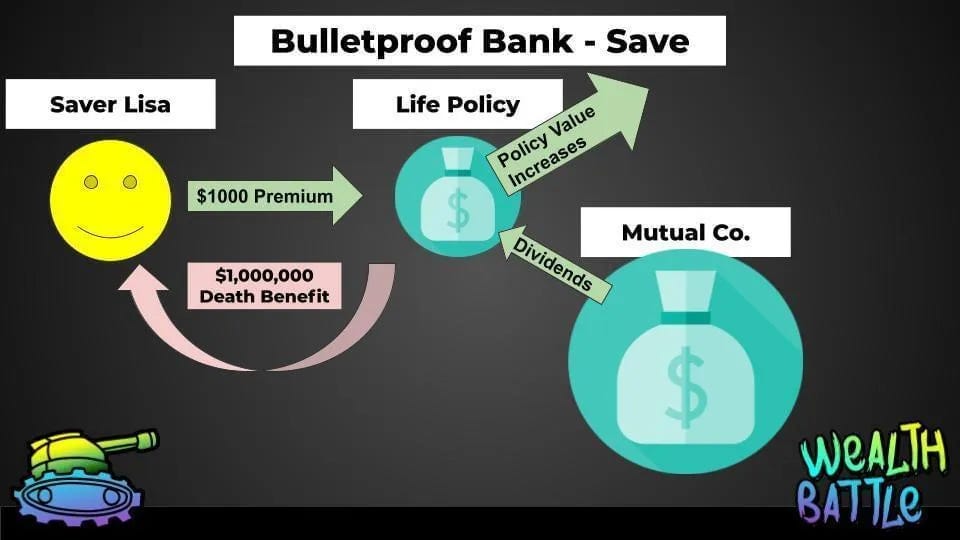

What is this asset? Whole term mutual life insurance.

Mutual life insurance companies are for-profit entities owned by policy holders like you. The institution is older than the Federal Reserve. They have survived the Civil War, Great Depression, and Great Recession.9

A whole life insurance policy makes you a part owner in these companies. They prefer long-term profitability over short-term results. They invest in main-street businesses and real-estate here in the States and Canada.

The cash value of your policy grows guaranteed at the rate of interest. Companies also usually pay non-guaranteed dividends. These improve as the policy grows and matures.

When you need cash for any reason you give your insurance company a call. Once you pass a security check, they send a check or deposit your way. This is a powerful way to fund cash-flowing investments in business or real-estate.

Your agent needs to structure the policy with care. Policies can become taxable if not correctly structured. Start small and build up as you feel comfortable.

You also get a death benefit to pass on to your family when you die. Your policy benefit should be outside the taxable system with effective state planning.

Ready to learn more? My friend Lisa’s has an in depth video explanation over at WealthBattle.