The occasionally insightful and often bizarre historian, Yuval Noah Harari recently commented on Bitcoin:

The preference for Bitcoin is based on distrust of human institutions. Why is this an alarming development? Because the whole purpose of money is to create trust between strangers. Financial devices like currencies, bonds and shares – 90% of which are just data in computers – build trust between millions of strangers, who can then pool their knowledge and resources together, and cooperate. Humans control the world because we learned to do this.

If we now lose trust in human institutions, this will limit the amount of money and handicap economic activity and cooperation. I hope that humanity finds a way to build trustworthy human institutions, instead of adopting technologies of distrust.

I tip my hat to the excellent historian and very failed podcaster, Tom Woods. In his newsletter he replies:

Your personal opinion of Bitcoin, pro or con, is not at issue here, so it is not necessary to send me a treatise on the subject. What is at issue, and what is simultaneously amusing and revealing, is his alarm at the prospect of more and more people coming to distrust fiat money.

First, he tells us that Bitcoin is based on "distrust of human institutions" -- but Bitcoin, not having been sent to us by Mars, is itself a human institution. Its stated purpose is to improve on existing human institutions. So when he says he hopes "humanity finds a way to build trustworthy human institutions," that's pretty much exactly what Bitcoin developers and supporters say they're doing.

If it's a decline in "trust in human institutions" he fears, perhaps he could trouble himself to take a moment to understand where that distrust has come from. Instead of blaming the victim, he might consider why someone might disapprove of fiat money and/or central banks.

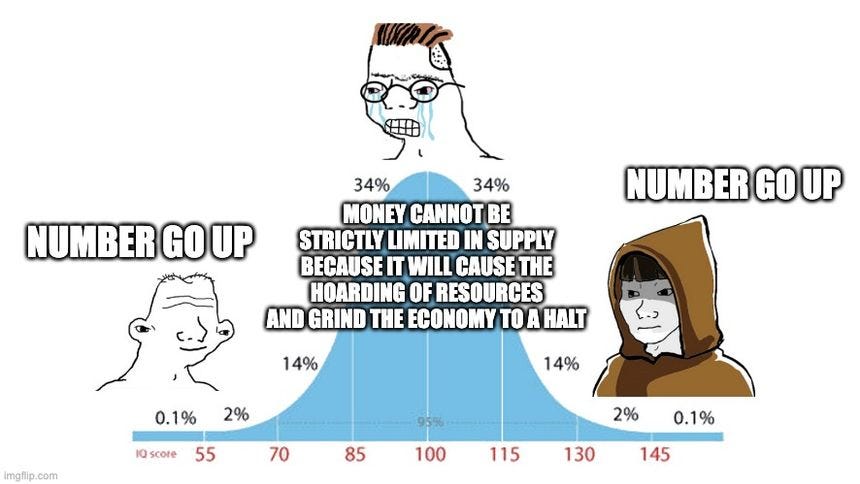

We don't like a money that loses its value over time; gold, by contrast, held or gained in value. The Fed's lackeys have tried to gaslight us into believing that it's a bad thing for a money to gain in value over time because this amounts to "deflation," which they have portrayed to us as the worst thing imaginable. I've discussed this on the Tom Woods Show numerous times, so I'll say simply: (1) it is not the worst thing imaginable; it is actually a very good thing; (2) falling prices (which is the flip side of a money gaining in value) is a natural result of unhampered capitalism that only a misanthrope would want to counteract; (3) all the arguments about why falling prices are bad are extremely stupid and not worth anyone's time.

We don't like a money whose supply can be increased at the whim of a small group of technocrats, and used to benefit or bail out particular firms or sectors. This is not only grossly unfair, but it also leads to a moral hazard problem: financial actors are more reckless than they would be in the absence of such a money.

We don't like a money the manipulation of which interferes with the natural level of interest rates, and thereby sets the economy on an unsustainable course that culminates in recession/depression (this is of course the Austrian theory of the business cycle).

So if Yuval Harari would like to make himself useful, he might go ahead and criticize those things, instead of criticizing people who quite understandably are trying to create an alternative to that kind of money.

Tom refers to modern currencies as fiat money. Before the 20th century, paper money was usually backed by a commodity like gold or silver. You could go to certain banks and vaults to trade your paper in for the face value in precious metals. In the US, this practice ended during the administration of the dearly beloved President Richard Nixon. Since then, the Federal Reserve Notes have had value based only on people’s trust in the banking system.

Why does Bitcoin matter?

The purchasing power of the US dollar has fallen off a cliff since the gold window closed. A dollar in 1920 was worth over 25 times more than what it was in 2020. This stylized chart comes from data of the US Bureau of Labor Statistics:

Not pictured in this chart is the Covid hysteria and accompanying inflation. Still, folks in the US have it better than many countries in the world. Over 10% yearly price inflation is common in many areas of Latin American, Africa and Asia. Bitcoin aims to solve this problem by creating a new store of value: a digital token that is controlled by software rather than a corporate banking system.

The idea is that the supply of Bitcoin is limited and stable. The high transaction costs of the token make transactions expensive, but people find the token quite valuable. You can see the results of the price of Bitcoin denominated in dollars in this chart from Investopedia:

Bitcoin is a human institution

Bitcoin and blockchain networks are definitely difficult to understand to your average person. It’s easy to get distracted by the speculative hype of magic internet money, so I want to briefly explain these technologies.

The concept of blockchain and cryptocurrency is derived from public key cryptography. This computer software technology was developed in the late 70’s and enables much of the world-wide web including banking and email. It involves a pair of encryption keys. From Wikipedia:

Each key pair consists of a public key and a corresponding private key. Key pairs are generated with cryptographic algorithms based on mathematical problems termed one-way functions. Security of public-key cryptography depends on keeping the private key secret; the public key can be openly distributed without compromising security.

Bitcoin builds on this technology, which almost certainly invented by humans, to also incorporate a distributed ledger that runs on a decentralized computer network. The network of computers each run the Bitcoin software. As transactions happen, the software validates these transactions and publishes them to a record.

Bitcoin is an entirely open source technology. That means you, your buddy, and the banshee queen Elizabeth Warren can all sit down with the source code and few coding books from Amazon to learn how it all works.

Invest with confidence

My friend Joe Withrow runs a membership group called the Phoenician League that aims to get it’s members on track towards financial freedom. This also includes a rock solid course to master your finances in 30 days including:

What is money?

How to allocate assets

How to get started buying assets like stocks, precious metals, real estate, and Bitcoin